• News

Benefits of Digital Receipt Capture

5 min

read

—

Dec 4, 2024

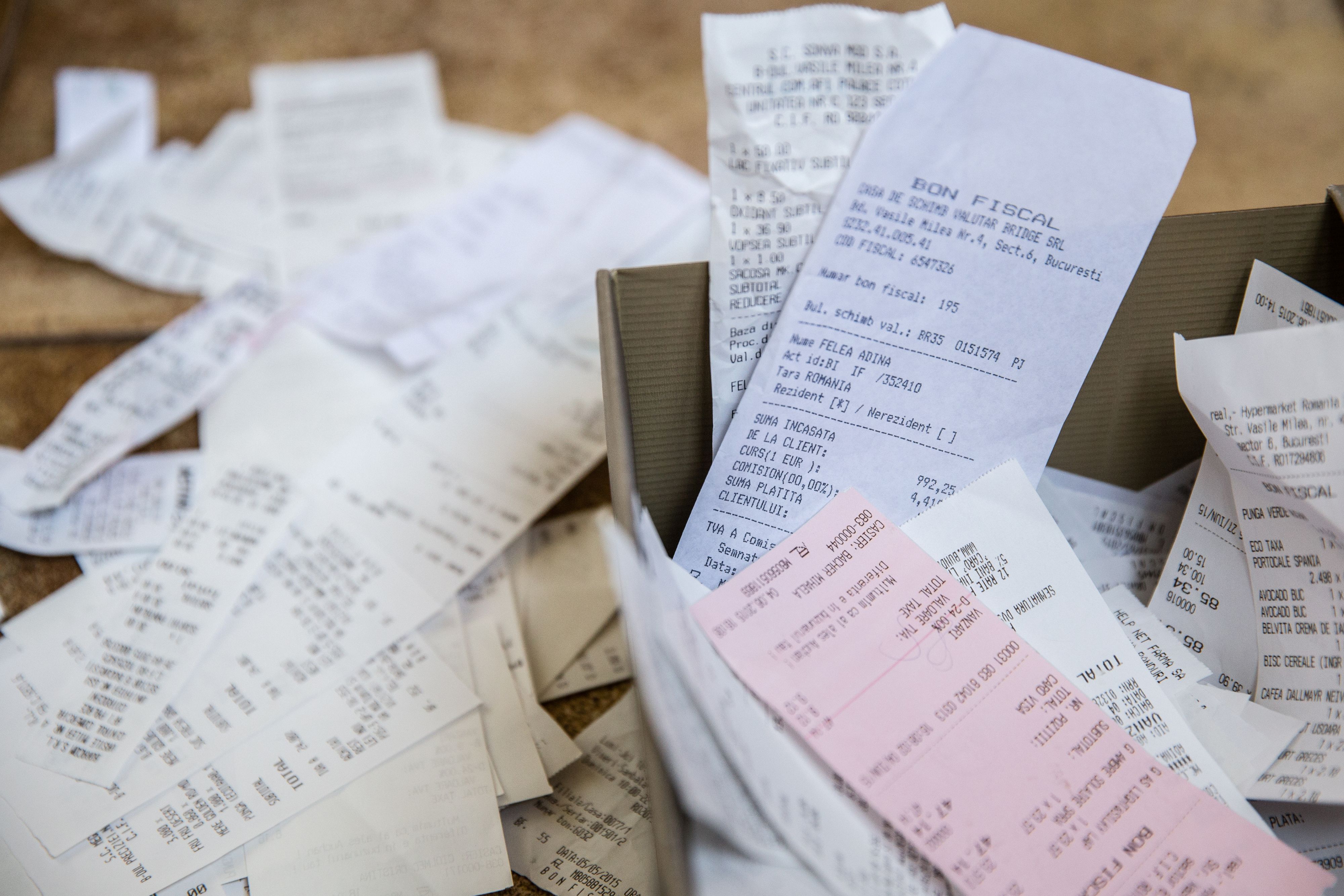

When managing business finances, perhaps nothing is more frustrating than receipt management. Paper receipts and invoices clutter the desks of accounts payable employees as they manually enter expense data into spreadsheets before filing them in massive filing cabinets. And if any receipts or invoices are missing, these same employees must spend additional time tracking down the individual who made the purchase and get the receipt from them - assuming it hasn’t been lost or thrown away. Fortunately, with recent advances in finance management technology, receipts can be digitally captured and stored - making it easier to track expenses and stay compliant with IRS requirements.

What Are the Benefits of Digital Receipts

In addition to reducing the time spent reconciling expense accounts, digital receipts provide several benefits to both large and small businesses.

Fewer Filing Cabinets

Depending on how many receipts your company collects, you could very easily fill multiple filing cabinets with proof of purchase documents. Some companies have so many receipts that it doesn’t really make sense to keep them because keeping them in files would fill up entire offices. With digital receipts, the information from every purchase is stored in the cloud and can be accessed online from anywhere.

Faster Access

Paper receipts in a filing cabinet are not very easy to access. If you need information about a specific expense, you may spend 20 minutes searching for the right folder and document. Digital receipts can be easily searched from your keyboard. You are providing you the information you need in 20 seconds or less.

Peace of Mind

Just because your business has never been audited by the IRS before doesn’t guarantee it will never happen. And if you don’t have the expense documents they request, it could result in higher business taxes and extensive penalties. Digitally stored receipts can help you ensure that you are ready for an audit if (and when) it ever happens.

Challenges to Implementing Digital Receipts

Digital receipt capture is growing in popularity, but is still underutilized. Often this is because businesses are reluctant to try new technology or they don’t have the capacity to train employees on using a new system. Outpave understands these issues, and we have made our digital receipt capture as user-friendly as possible.

It’s All in the App

The only thing needed to digitally capture a receipt in Outpave is a smartphone and the Outpave app. Once a purchase has been made, the app provides clear prompts on how to take a picture of the receipt and immediately allocate the expense. No special codes are required. No manual data entry. Just swipe the card. Snap a picture on the phone. And assign the expense to the proper allocation. All within minutes of making the purchase.

Stop the Guesswork

One of the most frustrating aspects of account reconciliation is matching the vendor with the expense. The vendor name in the bank statement doesn’t always match the vendor name on the receipt. And even digital receipts have not solved this issue - UNTIL NOW. Outpave offers a unique technology that generates the vendor's common name in the Outpave dashboard. So you can quickly match the digital receipt with the vendor. No more guesswork. Just precision receipt management.

Get Started Today

If you’re ready to improve your receipt management, click the "Get Started" button to request a demo today. Don’t forget to follow our social media channels for more information about how software can improve your finance management.

.webp)